Tax Planning with SabhyaFN

At SabhyaFN, we understand that effective tax planning is a crucial aspect of financial management that can significantly impact your overall financial well-being. Our dedicated team of tax experts is here to help you navigate the complex landscape of tax laws and regulations, optimize your tax liabilities, and maximize your tax efficiency.

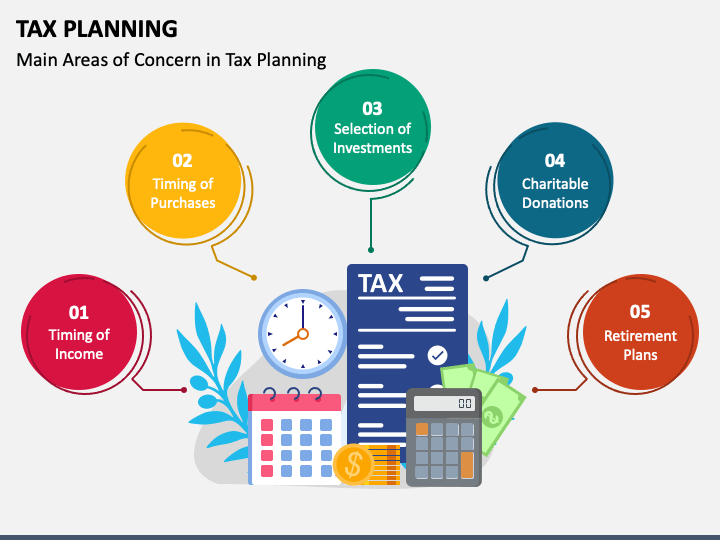

Why Tax Planning Matters:

Tax planning is not just about minimizing your tax bill; it’s about maximizing your after-tax income and preserving your wealth for future growth. Here’s why tax planning is essential:

Maximize Savings: By strategically planning your finances and taking advantage of available tax deductions, credits, and incentives, you can minimize your tax liabilities and keep more of your hard-earned money in your pocket.

Achieve Financial Goals: Effective tax planning allows you to allocate more resources towards your financial goals, whether it’s saving for retirement, funding your children’s education, or investing in your business, helping you achieve financial security and prosperity.

Reduce Financial Stress: Proactive tax planning can help alleviate financial stress by providing clarity and certainty regarding your tax obligations, ensuring that you are prepared and compliant with tax laws, regulations, and deadlines.

Our Approach to Tax Planning:

At SabhyaFN, we take a proactive and personalized approach to tax planning, tailored to your unique financial situation and goals. Here’s how we can help:

Comprehensive Analysis: We conduct a thorough analysis of your financial situation, including income, expenses, investments, assets, and liabilities, to identify potential tax-saving opportunities and strategies.

Strategic Planning: Based on our analysis and your objectives, we develop customized tax planning strategies aimed at minimizing your tax liabilities, optimizing your tax efficiency, and maximizing your after-tax income.

Year-Round Support: Our team provides year-round support and guidance to help you navigate tax-related issues and decisions, including tax implications of major life events, investment decisions, and business transactions.

Tax Compliance: We ensure that you remain compliant with tax laws, regulations, and reporting requirements, helping you avoid penalties, fines, and legal consequences associated with non-compliance.

Our Tax Planning Services:

At SabhyaFN, we offer a comprehensive range of tax planning services, including:

- Income Tax Planning

- Capital Gains Tax Planning

- Estate Tax Planning

- Retirement Tax Planning

- Business Tax Planning

- International Tax Planning

- Tax-efficient Investment Strategies

Get Started Today:

Ready to optimize your tax efficiency and achieve your financial goals? Contact us today to schedule a consultation with one of our experienced tax professionals and discover how SabhyaFN can help you navigate the complexities of tax planning and maximize your after-tax income.

For Tax Planning Services

Book Your Call Now!